We’ll all grow old someday, it’s an inevitable journey of life. Some of us will be lucky enough to be healthy till the day we pass, while the rest will eventually face a number of day-to-day physical struggles like going to the toilet or getting dressed.

This rather bleak possibility explains why the Singapore government introduced a disability insurance scheme, ElderShield, back in 2002.

Of course, the larger issue here is really Singapore’s ageing population, which the government has been trying to grapple with for years now.

The ageing population problem is compounded by two related issues: rising healthcare costs (which the government addresses with MediShield Life and Integrated Shield Plans) and the increasing reality that one in two Singaporeans could become severely disabled (which is what CareShield Life addresses).

Read on for more on how you might be affected by the newCareShield Life.

What is the new CareShield Life scheme?

Launching on 1 October 2020, CareShield Life is a new government-run disability insurance scheme that seeks to offer basic financial protection against severe disability. It covers only Singaporeans.

Singaporeans who are born in 1980 or after are automatically enrolled into CareShield Life, with no further action needed on our part.

- If you’re born from 1980 to 1990, you’ll be automatically covered under CareShield on 1 October 2020 OR when you turn 30 years old.

- If you’re born after 1990, you’ll be covered as soon as you turn 30 regardless of any pre-existing medical conditions and disability.

CareShield Life pays out in the event of severe disability. The payout starts from S$600/month in 2020 and increases every year to keep up with inflation.

For you to be considered severely disabled, you’ll need to be certified that you’re unable to perform at least three of the six Activities of Daily Living (ADL): washing, dressing, feeding, toileting, moving around, and transferring.

This certification status requires a Ministry of Health (MOH)-accredited severe disability assessor to grant you. Under CareShield, the first consultation will be free, while subsequent ones require payment fees on your part.

How much are CareShield Life premiums?

CareShield Life annual premiums start from S$206 for men and S$253 for women for 30-year-olds in 2020. They increase every year due to the payouts also increasing.

The premium term is a maximum of 38 years (e.g. pay premiums from age 30 to 67), but you are covered for life.

These are the premiums and terms for the most basic form of CareShield Life, which grants you a monthly payout of S$600 should you be certified disabled by a doctor. We’ll explain more on how to increase your monthly payouts later.

Take note that the duration of the payout lasts the length of your disability. So if you are only disabled for three months, you’ll receive S$600/month for those three months, or a total of S$1,800.

For more details on premiums for CareShield, you can head over to MOH’s premium calculator. The values are tabulated based on your age, gender type, monthly per capita household income (PCHI) and your residential property type.

If you are auto-enrolled into CareShield Life, you cannot opt out of it. But the good news is that you can use CPF savings to pay the premiums, including for any private insurer top-ups (see next section).

S$600/month isn’t near enough. Is there a way to increase the payout?

Now that you understand what CareShield Life is all about, the next question that comes to mind is: is S$600/month even enough to live on if you’re disabled?

Although CareShield Life’s S$600/month payout is certainly higher than its predecessor ElderShield, it still seems like a rather small amount to pay for all your living expenses, mobility equipment and home-based care. For those with dependents, it will almost certainly be an insufficient cushion against your loss of income.

That’s where CareShield Life Supplements come in. These are disability insurance plans that complement and augment the basic CareShield Life plan, but are provided by private insurers (Aviva, Great Eastern, and NTUC Income).

These plans will offer additional benefits that can enhance your coverage such as higher monthly payouts — think of them as similar to the Integrated Shield Plans that complement MediShield Life.

Can you use CPF to pay for CareShield Life Supplements?

Yes! CareShield Life Supplements are MediSave-approved, which is good news especially with the current economic situation making cash flow very tight.

You can pay the premiums for your Supplements via cash or by your own or your family members’ (i.e. spouse, parents, children, siblings or grandchildren) MediSave, up to a limit of S$600 per calendar year per person insured.

If your CareShield Life Supplement premium exceeds S$600, you’ll have to top up the rest in cash.

If you’re above age 40, should you upgrade from ElderShield?

We’ve mentioned that Singaporeans and PRs born in 1980 and after will be auto-enrolled into CareShield Life, but what about those who are older?

Singaporeans and PRs born in 1979 and earlier will have the option to participate in CareShield Life should they wish to.

Those born specifically from 1970 to 1979 will be automatically covered under CareShield Life if you’re already under ElderShield 400 and not severely disabled. For the rest, you can opt-in.

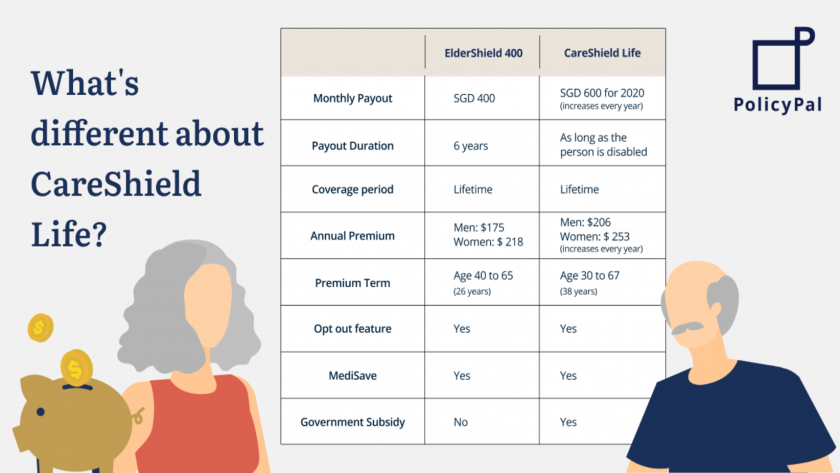

Here’s a summary of ElderShield vs CareShield Life for easy comparison.

In terms of benefits, CareShield Life is definitely much better than ElderShield. The payouts are higher (and keep up with inflation) and last as long as your disability (instead of terminating at six years).

CareShield Life costs more, however. Do note that should you choose to opt in for CareShield, you are required to top up the premiums to replace your old ElderShield plan.

If you’re already currently enrolled in ElderShield, you will continue to enjoy ElderShield benefits unless you choose to opt in to CareShield Life. There will be no lapse in coverage.

Should you bother with CareShield Life if you’re still young and healthy?

Yes! We think you should definitely factor CareShield Life into your overall insurance portfolio even while you’re still young and healthy.

For a start, the fact that the government has made CareShield Life mandatory for all Singaporeans and PRs suggests that the possibility of a severe disability in your lifetime is very real.

CareShield Life does not only cover disabilities resulting from old age or illness. If you get into an accident and are severely disabled temporarily — which can happen at any age — you also qualify for CareShield Life payouts.

Far from being irrelevant, CareShield Life is actually a great complement to many Singaporeans’ existing insurance policies as it protects against income loss resulting from an accident.

Since it’s compulsory, we should factor CareShield Life in when considering our insurance needs. It’s actually a great way to get extra coverage at a highly subsidised rate.

Now, it wouldn’t be an ultimate guide without an actual guide booklet would it? Here’s our PolicyPal CareShield Life Guide where you can find all the relevant and necessary information relating to CareShield Life.

If you like to have everything at a glance, our guide booklet is there for you!

Enquire More and Contact Us Today!

Learn more about how to manage your insurance policies and identify your coverage gaps.

To get in touch, you can WhatsApp us at +65 8750 0688 and we’ll get back to you. Alternatively, leave your details below and we will contact you at your convenience.

[xyz-ihs snippet=”Generic-No-Checkbox-Leads-Form”]

Read more:

Aviva Singlife Merger: Here’s Everything Policyholders Need to Know

CPF Investment Scheme: What Can We Invest Our CPF Savings In?

10 Long & Short Term Endowment Plans in Singapore (2020)