If you are diagnosed with a Critical Illness such as cancer, hefty expenses are definitely unavoidable. Here’s a breakdown of how you can ensure sufficient financial protection through the course of your treatment and recovery.

If you are a Singaporean or Permanent Resident (PR), you are automatically covered under MediShield Life – a basic health insurance plan administered by the Central Provident Fund (CPF) Board. You can also take up an Integrated Shield Plan (IP) offered by private insurers, which provides benefits in addition to those offered under MediShield Life.

But why do I still need Critical Illness insurance coverage?

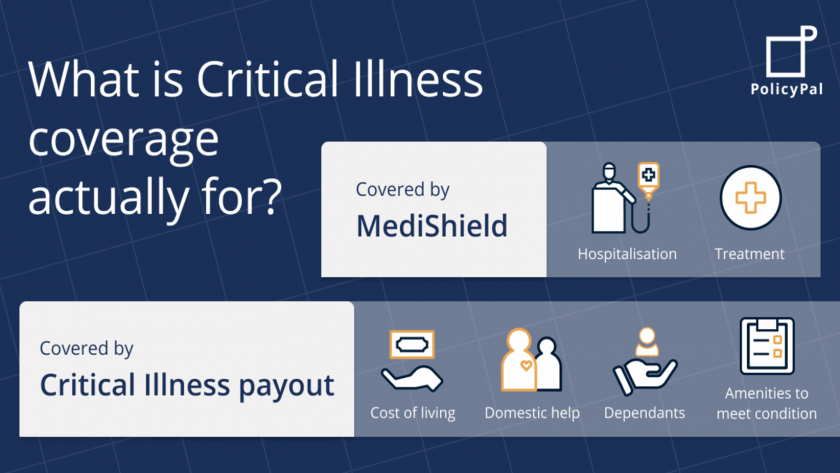

While MediShield Life and its counterparts may help cover your hospitalisation bills, it lacks the component that provides significant amounts of cash payouts to tide you through the recovery period. With some of these illnesses requiring recovery periods that are longer than our hospitalisation, medical and annual leave combined, you are very likely to face a loss of income due to your inability to work during your recovery period.

Your Critical Illness payout will go to covering costs such as bills, domestic help, supporting your dependants, and additional home amenities to aid your day-to-day life.

What should I look out for when buying a Critical Illness Insurance Plan?

While it is easy to simply choose the cheapest Critical Illness plan, it is important to understand that not all of the insurance companies structure their plans the same way. It is important to examine the features of the different policies and find one that suits you.

Here are some factors you can consider

1. How much coverage do you need?

The coverage amount should be based on your financial needs which include your expected expenses, ongoing financial obligations and the period during which you cannot work due to the treatment and recovery.

2. What is covered?

While the Life Insurance Association of Singapore has standard definitions for 37 severe-stage critical illnesses, some insurers may offer critical illness plans that may vary in the number and types of critical illnesses covered.

In addition, some insurers offer critical illness insurance plans that cover early, intermediate and late stages of critical illness. There are even critical illness insurance plans that allow multiple claims from the same policy.

3. How long are you covered for?

The coverage tenure can also differ across different Critical Illness Insurance Plans. While some plans provide coverage till the age of 100, others have shorter coverage tenure. It is important to choose one that provides the best fit for both your needs and financial ability.

4. Your family history

Before buying a Critical Illness Plan, it is important to consider your family’s medical history. If your family has a history of a certain critical illness, ensure you obtain coverage from the policy. For diseases with a high incidence of recurrence such as cancer, it might be good to consider multi-pay plans.

Enquire more and contact us today!

Read More:

Welcome to Adulthood: Insurance Edition

Escaping The Squeeze of The Sandwich Generation: Three Important Rules

Guide To Pet Costs and Pet Insurance in Singapore