There are many personal accident plans offered in Singapore. Choosing a suitable plan can go a long way in terms of how much you pay every year and what benefits you will receive in the event of an accident.

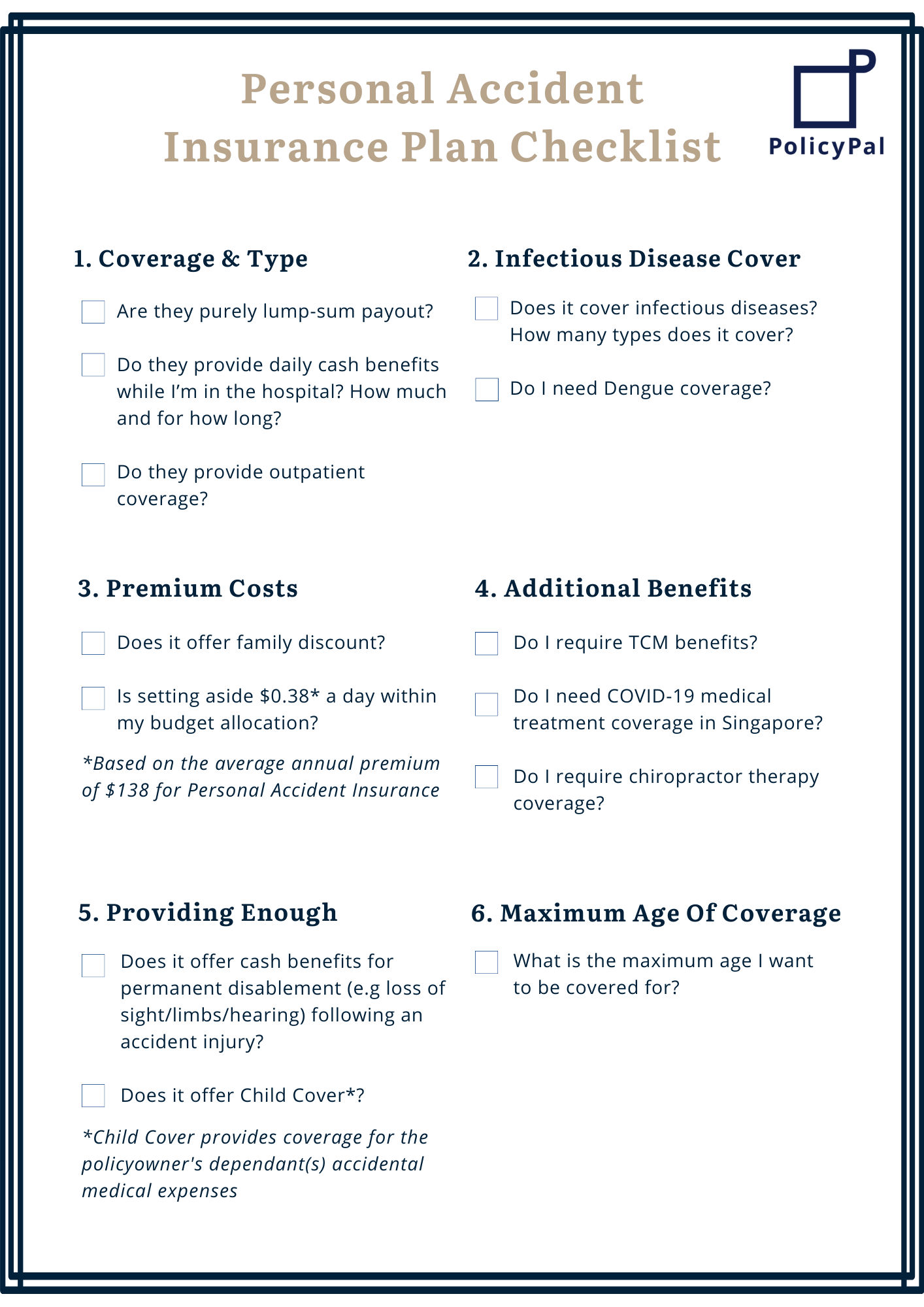

We have collated a checklist of factors to consider when taking up a personal accident plan:

In this article, we will be going through the following six factors you should take note of before purchasing a personal accident plan.

In this article, we will be going through the following six factors you should take note of before purchasing a personal accident plan.

1. What Benefits Does The Plan Offer?

The first thing in your research is understanding the coverage provided by Personal Accident plans. Personal accident plans usually offer the following benefits: Lump-Sum payment for Accidental Death & Permanent Disablement, Medical Expenses Benefits, and Hospitalisation Cash Benefits.

The coverage usually differs with plans from different insurers, with some plans like NTUC Income’s PA Assurance offering all of the benefits mentioned but requiring higher premiums. Insurers usually also offer different tiers of the same plan depending on your budget and the type of coverage you are looking for.

The lump-sum payment provides a one-time payment of the sum assured if you pass on or are permanently disabled, as a result of an accident. This is the key benefit and is the core of personal accident plans in general.

Medical Expenses Benefits provide coverage and payment for medical expenses, such as inpatient and outpatient expenses for treatment of injuries resulting from an accident. Some insurance plans would also offer ambulance and mobility aid benefits up to a specific amount.

Daily Hospitalisation Cash Benefits provides you daily cash payout throughout the period when you are hospitalised. One example is AXA’s SmartPA Protect+ which for an additional premium, provides an add-on for hospitalisation cash benefits of up to $250/day for 365 days per accident.

2. Is It Purely Physical Accident, Or Does It Include Coverage For Infectious Diseases?

The COVID-19 pandemic is a reminder that there is no universal safeguard against infectious diseases, which is where personal accident plans may be useful. One of the benefits of getting a Personal Accident plan is infectious disease coverage. Depending on insurers, the benefit is either included or can be added on as an option for an additional premium. Having coverage for infectious diseases provides you with peace of mind against the financial impact if you are stricken with such infectious diseases.

Liberty PACare Plus Enhanced provides comprehensive coverage for infectious diseases, covering over 22 different infectious diseases ranging from Dengue, Rabies, MERS to ZIKA.

3. How Much Am I Willing To Pay Every Year For A Premium?

Premiums can vary depending on the range of coverage offered by insurers. Some insurers have a tiered system that provides different premium pricing structures for a range of benefits and coverage amounts.

Premiums for personal accident plans are dependent on occupation. If the insured’s occupation involves manual labour, he can expect to pay a higher premium for coverage. Fortunately for personal accident plans, medical underwriting is not required. However, do note that accident plans do not cover any pre-existing conditions!

In terms of premium affordability, you can get covered for as little as $0.38 a day depending on the type of plan. But of course, how much you pay depends on how much coverage you want and what you can afford. Do remember to keep the premiums within your budget allocation.

MSIG Personal Accident Insurance offers some of the more affordable premiums in the market. Their Silver plan provides personal accident coverage at only $86.14 annually compared to the industry average annual premium of $138* for personal accident plans.

*Premiums are not guaranteed, and renewal is up to company discretion.

4. Do I Really Need The Other Benefits?

Some insurance companies will entice you to get their plans by adding as many benefits into their plans as possible. But it comes at a cost, and that cost is the additional premiums that you pay. For some people, having extra benefits can be more convenient if it reduces the number of plans you need.

However for others, do first ask yourself if you require benefits such as child cover to pair with your personal accident plan or if it is more beneficial to have a standalone child personal accident plan such as the SOMPO PAJunior that provides comprehensive coverage for children against accidents and up to 17 infectious diseases.

Certain personal accident plans also include medical treatment by Traditional Chinese Medicine (TCM), chiropractic and physiotherapy. If you turn to Traditional Chinese Medicine (TCM) treatments often you may choose to opt for plans that include this benefit. For example, NTUC Income PA Assurance provides up to $1,250 per accident for TCM benefits and up to $5,000 per accident for physiotherapy.

5. How Does It Benefit My Loved Ones If I’m Gone After An Accident?

One of the reasons to get an accident plan is to have some financial protection for your family in case you pass on following an accident. Accidents can also leave you unable to work for a period due to temporary disability. It is thus important to protect your health and wealth and not allow an accident to wipe out your financial resources. Personal Accident plans will be able to provide coverage for accident-related medical expenses and some plans may also pay out some money during the period you are hospitalised.

The severity of the injury will hinder your ability to generate income in the future as well. Hence, we have to ask ourselves if the policy provides sufficient coverage in the event of dismemberment (loss of sight; loss of both upper and/or lower limbs).

6. How Long Do I Need My Coverage To Last?

Some of us find value in being covered with a personal accident plan, while others might find paying premiums for a personal accident plan is not worth it especially if we already have an existing term life plan and a hospitalisation and surgical plan.

As you grow older, the risk of getting into an accident increases just as you’re more likely to require a longer period of rehabilitation and more follow-up treatments/services as a result of your accident. Personal accident plans can complement your existing insurance coverage to fill up the coverage gaps.

Most personal accident plans cover the insured until they are 70 years old. Tokio Marine 365 plan provides comprehensive worldwide protection for you and your family. If you are enrolled under the 365 plan before 65 years old and there is no lapse in coverage from missed premiums, you are eligible for premium renewal and coverage until you are 85 years old.

Conclusion

Personal Accident plans help you to cope with disruptions arising from accidents and cover potential gaps in your existing coverage which may leave you and your loved ones financially vulnerable.

Now that you have an overview of what to know before getting a personal accident plan, you might want to find out which plan(s) is/are suitable for your needs. Get a quote from the PolicyPalFA team, or visit our website to find out more about the insurance plans we provide.

Do check out our latest promotion! Get $10 OFF your personal accident plans by using promo code “PA10”. Terms and conditions apply.